Housing prices are one of these never-ending topics of our generations: everyone is aware of them, everyone is exposed to them, everyone worries about them. Of course, when a ton of people with very little economic understand try to analyse and understand certain economic phenomena, they are bound to make serious errors. So yet again I decided to have a quick look at the fundamental driver of Stockholm housing prices, and why the hysteria surrounding this (and many other current topics, see Austerity or Inequality) is much overrated. This, as much of my writing, came out of frustration with Chicken Little-style doomsday predictions – this time from the otherwise quite brilliant ZeroHedge.

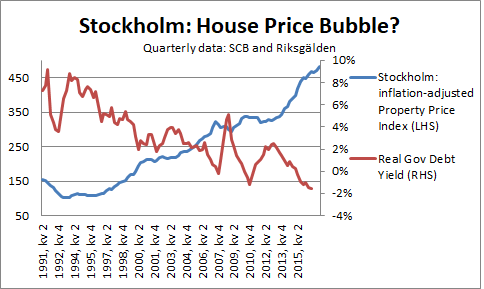

Yesterday ZeroHedge reiterated some of the doomsday nonsense they are known for, this time applied to the Swedish property market. The basic story, likely to get people outraged, is the following graph and the bubble story coming with it:

Most observers presumably see this and go "Sh*t! THIS is gonna blow!", and in many ways the development of the property market over the last three decades is a topic worthy of that kind of attention. It is also surprisingly unique in historical terms. Really, rising real housing prices are an anomaly that we've only really seen these last three-four decades.

But people are short-sighted, great at forgetting or perhaps have more important things to do than study the economic history of the cities they live in – or even scrutinise their data a bit deeper. In many of the world’s largest cities and most attractive locations (London, Sydney, San Francisco, Paris, Stockholm etc) the story is the same: seriously rapid increases in real housing prices. Enough to convince people that “housing prices always increase”, and other nonsense statements such as “housing is a safe investment” or praises of how important home-ownership is for cohesive societies and thriving communities.

No, housing is consumption, and has always been consumption. Whatever else comes with it sociologically or emotionally is beyond my expertise. Though I'll happily comment on the financial *bubble factor* involved here.

Having said that, let me explain in a very simple way why this graph isn’t even half as intimidating as it seems. Indeed, most serious economists agree that the Stockholm property market is not a bubble, using arguments about urbanising, migration, income growth etc. (or supply factors of government regulations and zoning laws!), that convincingly explain why housing prices have risen so quickly. To this they generally add the greatest experiment of our times: our weirdo monetary regimes.

I simply took the SCB (Statistics Sweden) data for Stockholm housing prices (which seems to be roughly the same as the one used to create the scary graph above) and used my birthday as a relevant historical cut-off point since that captures the more recent price increases we're so worried about. Then I graphed it against the "Risk-Free" real interest rate, i.e. yield on Swedish Gov debt deflated by price changes (using standard methods). This is the result:

Now, let me finish with an important but boring disclaimer. The global fall of real interest rates over the last decades largely explains the development of housing prices – meaning: not a bubble – but that doesn’t mean prices could never fall. They can. When (or if*, which I still find rather unlikely) real interest rates again bounce up, housing prices will fall – but that doesn’t mean the bubble has finally popped. When and if prices fall, you’ll have pundits like ZeroHedge running victory laps and crying “WE TOLD YOU SO!” – except that every introductory finance class did so too; asset prices are intrinsically linked to real interest rates; when they increase prices should fall, all else equal.

Lastly, stop crying ‘bubble’ every time some relative price changes faster than you’d like. Among the very virtues of markets is that such prices can change; we even want them to change in order to incorporate and synchronise various unknowable preferences and desires of 7bn+ people. But rapidly-changing relative prices are not therefore bubbles; if the production lines of strawberries or Brazilian coffee or Florida oranges or California almonds face serious shortfalls (to name some recent examples) we’d expect prices of those goods to rise rapidly. Nobody can, let alone should, therefore conclude that there’s “an almond bubble” or a “coffee bubble”. Same thing goes with housing prices, but on a larger scale.

Stop seeing bubbles everywhere, and start using that economic sense of yours. Or, as one of my lecturers at University of Sydney used to say: It's the interest rate, stupid.

Thank you for sharing such great information.

ReplyDeleteIt is informative, can you help me in finding out more detail on

property loan interest rates.

I am very much pleased with the contents you have mentioned. best school in mayur vihar I wanted to thank you for this great article.

ReplyDelete

ReplyDeleteThank you so much as you have been willing to share information with us. jeevan public schoolWe will forever admire all you have done here because you have made my work as easy as ABC

I am constantly surprised by the amount of information accessible on this subject. What you presented was well researched and well written to get your stand on this over to all your readers. Thanks a lot my dear. Businesses for sale Patong

ReplyDeleteFor that reason it is preferable you will want to similar analyze ahead of generating. You are able to release more effective post like this. free tour stockholm

ReplyDeleteThis is my first visit to your web journal! We are a group of volunteers and new activities in the same specialty. Website gave us helpful data to work. Bukit Timah Nature Reserve

ReplyDeleteWe tend to speak about typically the cost expression " googol" the 1 and then hundred zeros. https://imgur.com/a/1Vj0wSD https://imgur.com/a/XyBvqgG https://imgur.com/a/pNckCe4 https://imgur.com/a/XcQUux9 https://imgur.com/a/6jQBVIm https://imgur.com/a/TSQZe2N https://imgur.com/a/tNhFYBd

ReplyDelete